Introduction

Purpose of this document

This is a template for integrating with Avica Groups system. This can be modeled to fit each lender's system, but serves as a starting point. If used exactly like it is described in this document, the setup is more or less plug-n-play from Avica Groups point of view, and this document will serve as the documentation of the service. Examples of formats and names are however up for discussion, and can be customized to fit the individual lenders system, if needed. Some features are mandatory to implement (in some way or form similar to what is described), in order for the process to work.

Credentials and endpoint URLs are unique per lender, and will be communicated directly, and is not a part of this document.

Brief explanation of the flow and service

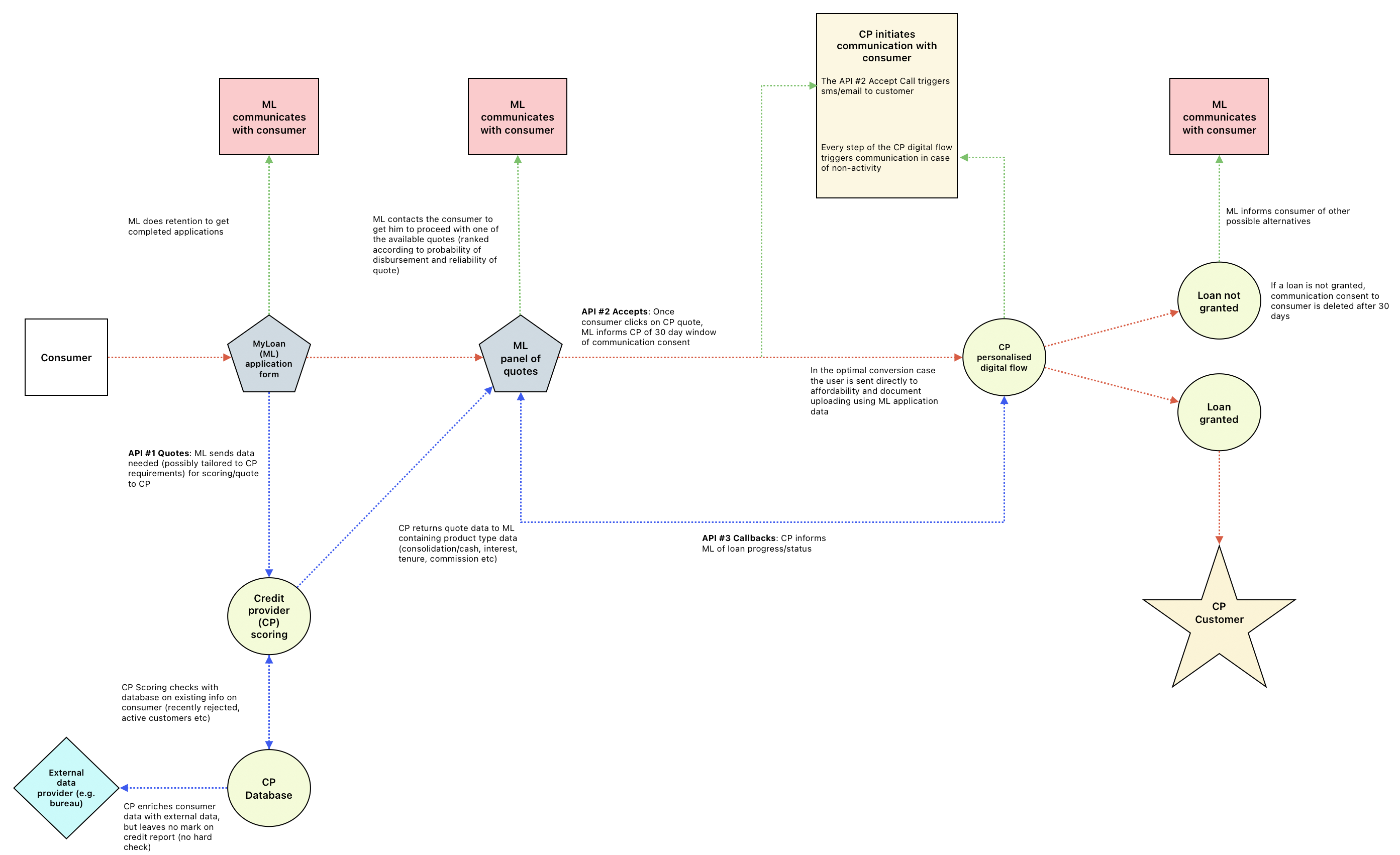

A customer is interested in obtaining a loan. Fill out the loan application form on the Avica Group website (Myloan.co.za). When all the needed information has been gathered and validated, all lenders in the Avica Group lender panel will be called with a loan offer request. All lenders that choose to grant a preliminary/indicative loan offer to the customer, will return the offer details to Avica Groups system. A list of offers will then be presented to the customer. If the customer is interested, he can choose one and accept it. When an offer is accepted, Avica Group will call the lender to let them know that the customer wants the loan offer.

The lender will now have the customer complete the loan process (signing etc.). During this process, the lender will inform Avica Group of the process status, as it changes, so that Avica Group knows if the offer gets rejected or disbursed to the customer.